ACIF Forecasts - November 2019

The Australian Construction Industry Forum has released its Construction Industry Forecast for November 2019.

The full forecasts are available on the ACIF website. We republish the summaries provided by ACIF below. Remember, ACA members now enjoy free access to the ACIF Customised Forecasts Dashboard. To sign up, head to this link.

Overview

The Australian Construction Industry Forum (ACIF) forecasts that the decline in Residential Building will be so deep that it will dominate the outlook for building and construction, dragging down economic growth and employment.

ACIF indicates there have been recent signs of improvement in some markets, but it will take time for the impact to be felt throughout all building and construction markets. “The lowest interest rates on record have been reduced even more; despite this, access to finance and credit has presented a significant hurdle to developers, builders, investors and owner occupiers. Market adversity has encouraged builders to withdraw from development of new projects; we witnessed new dwelling approvals plummet last year and commencements have also fallen. A fall in residential building activity is locked into the pipeline and it will take a while for this to be put into reverse”, said ACIF Construction Forecasting Council Chair Bob Richardson.

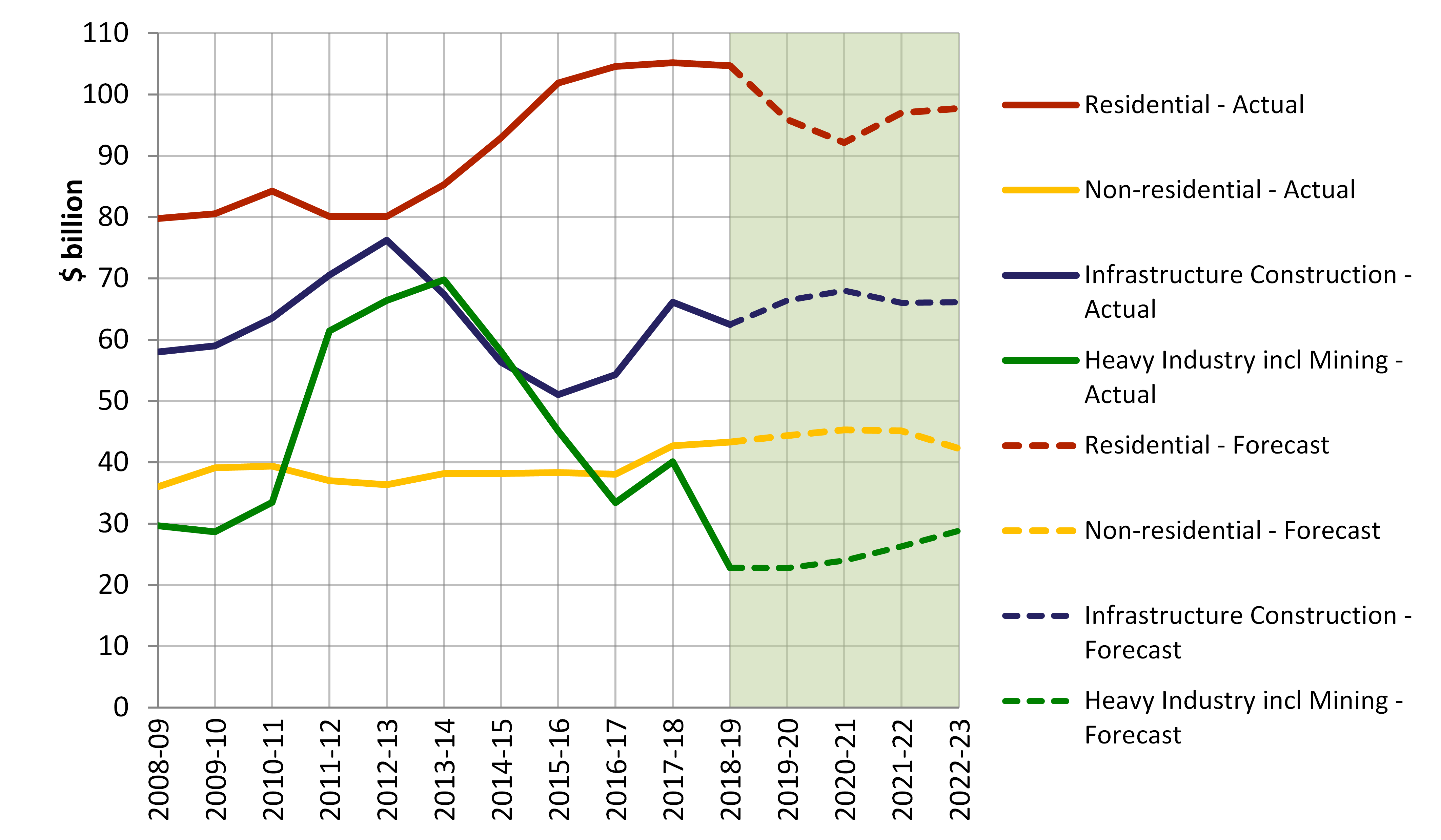

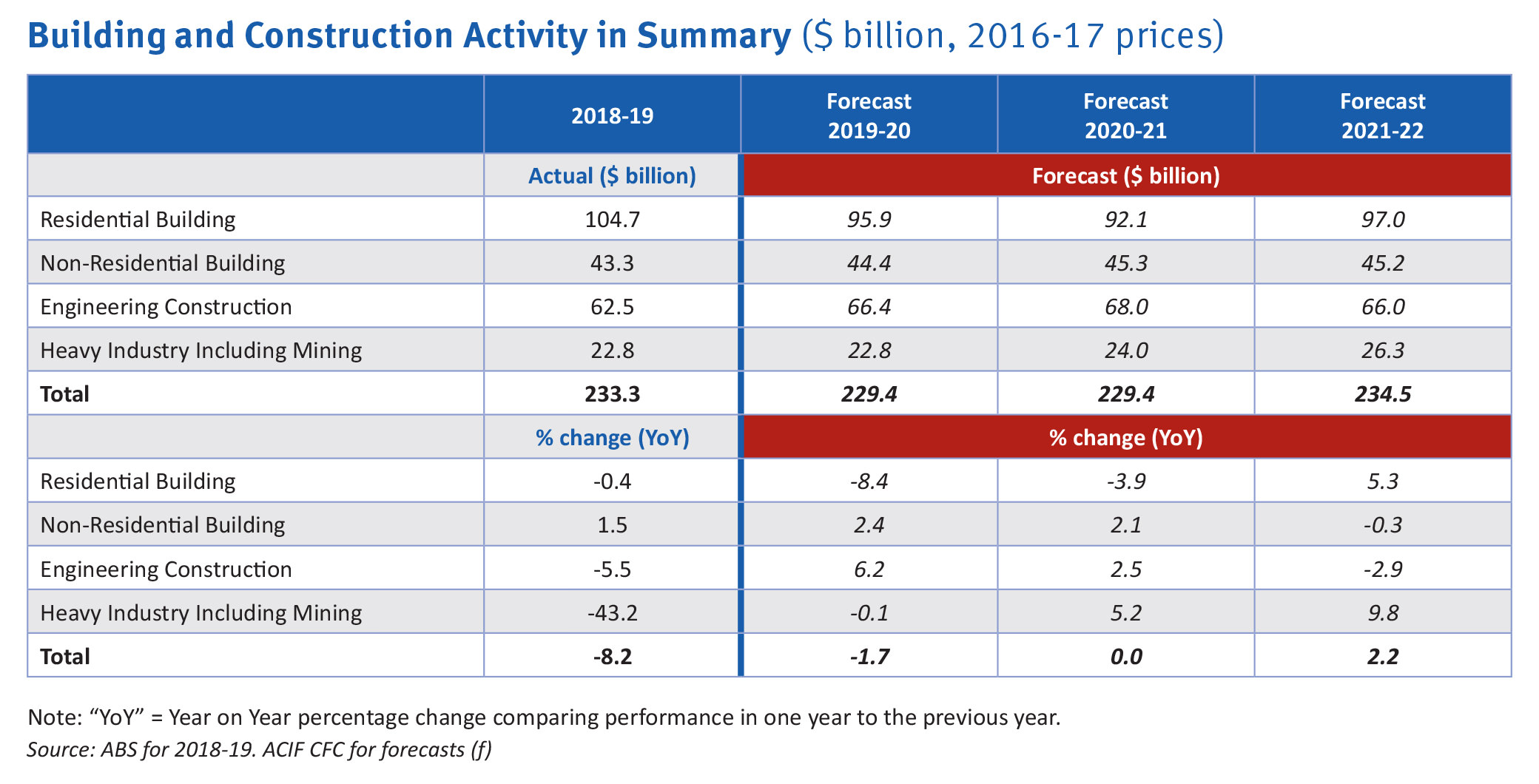

Residential Building Activity

Residential Building work fell 0.4% last year (2018–19). A much deeper contraction of 8.4% is expected this year (2019–20), dragging the value of work done down to $96 billion. The rebound in building activity is expected to be delayed until 2021–22. The drop in activity will be difficult to avoid despite recent improvements in house prices because it will take time to restore approval numbers, secure land and commence new projects and address other ‘lags’.

Non-Residential Building Activity

In marked contrast to Residential Building, Non-Residential Building activity is midway through a growth phase, with expanded business investment in Accommodation, Industrial and Offices, and Public sector investment, especially in Education and Defence. Growth is expected to continue through the remainder of this year and into 2020–21. This will raise activity to peak at $45 billion.

Infrastructure Construction Activity

Work done in Infrastructure Construction contracted by 5.5% last year to $62 billion. This reflected the completion of large projects, and delays in shifting to new projects, which are often in different sectors and geographies. Infrastructure construction activity is expected to return to growth in line with expanded plans and programs, raising work done to $66 billion in 2019–20 and $68 billion in 2020–21.

Total Building and Construction Activity

While the downturn in Residential Building activity is expected to deepen this year, the depth of the decline will be offset by increases in other building and construction activities. The expected rebound in Infrastructure Construction spending will be too little too late to prevent a fall in total building and construction activity this year. Growing Infrastructure Construction spending will be sufficient to stabilise the amount of building and construction work to be done in 2020–21 and lead to a return to growth in 2021–22.

Employment in Building and Construction

Construction employment is projected to fall 2% to 1,159,000 jobs over this year, reflecting the significant decline in Residential Building activity that will be difficult to avoid. This is a concern because Residential Building is the most labour-intensive type of building and construction. Construction employment is projected to track sideways for 2–3 years based on relative stability in the level of total building and construction activity.

Industry Outlook

Total building and construction work fell 8.2% last year to $233 billion. A further fall of 1.7% is expected this year (2019–20). Most of the large losses in Residential Building activity are expected to be offset by increases in Infrastructure Construction and Non-Residential Building.

ACIF Forecasts are rolling ten-year forecasts of demand across residential, non-residential and engineering construction in Australia. The Forecasts are prepared by respected economic modellers, using high quality data sources, and are overseen by ACIF’s Construction Forecasting Council, an industry panel of expert analysts and researchers.