2017 ACA Budget Impact Survey

The ACA’s 2017 Federal Budget Impact Survey aims to understand what the budget means for architectural practices and the profession, and thereby inform ACA advocacy and activity. We present the results below, and encourage members to also read John Held’s analysis of this year’s results.

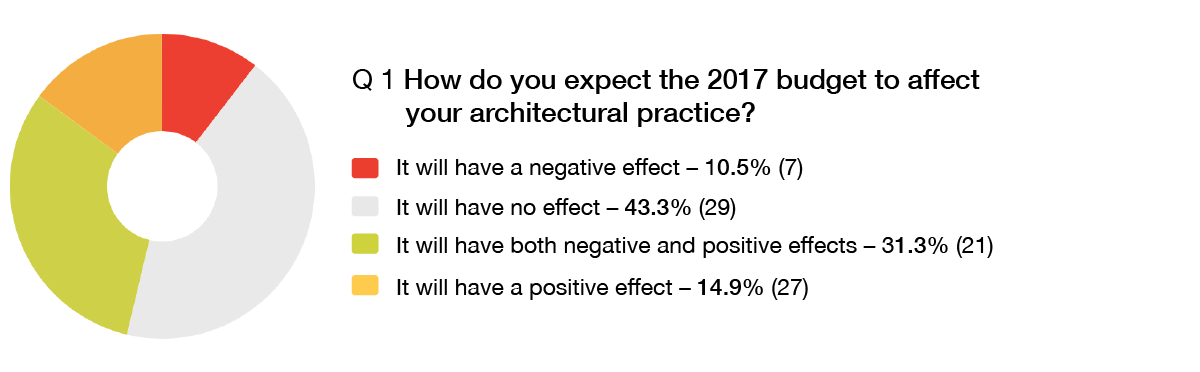

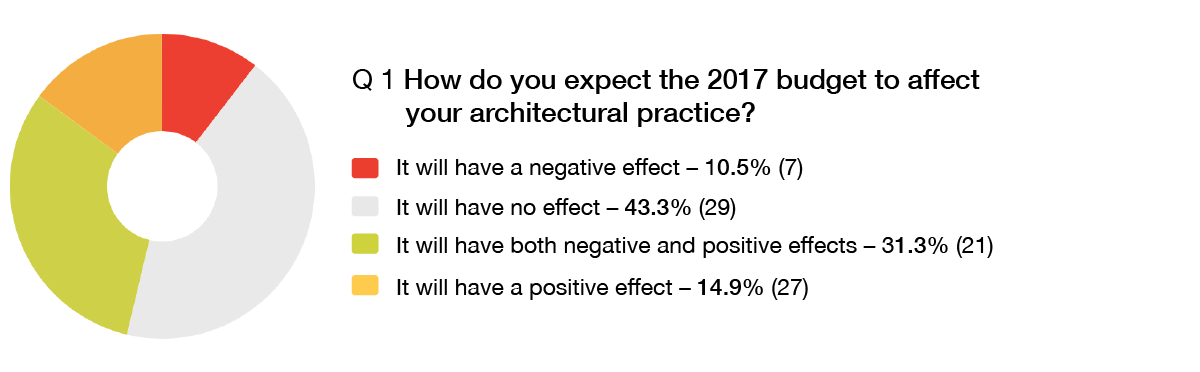

The first set of questions aimed to provide a general understanding of the expectations of the impact of the budget on individual practices, the profession and society more broadly.

Impact on practices

Almost half of respondents see the budget as having no effect on their practice. Most of the 16 people who took the opportunity to comment made very brief comments. A number suggest that the support for housing and infrastructure may have some impact on architects. Cuts to the higher education sector are a concern for some working in the area, as is the lack of health funding. A sample of comments includes:

“There are some positive outcomes, such as funding for roads and rail in WA, however, with funding for universities getting tightened there will be fewer campus projects.”

“-ve: implications to Western Australia in loss of health and education revenue, reduction (as always) of GST share. +ve: infrastructure spend – metronet.”

“Minimal health funding for new projects.”

“Business confidence plus the big infrastructure spend should boost business.”

“Infrastructure items are supported; changes to superannuation for access to funds for house purchases for first home buyers are supported.”

“Only if we use the $20K instant asset write-off, which we may not do.”

“Possibly with the tax cuts, but they may not affect the size of our business.”

“Cutting red tape on building applications – though this may have a negative affect if it allows building companies to get applications through without the use of architects.”

“Infrastructure spend will flow to government projects in education and other areas.”

“Bank tax will bite us all.”

“Less uncertainty with the removal of the zombie measures and funding commitment for NDIS.”

“Positive for revenue, poor outcomes for environmental effects IMO.”

“Running a small scale practice in Tasmania, the key budget strategies will have no affect at all. There is nothing in the budget (aside from the 1 year continuation of the $20,000 asset write off) that will have any effect on what we do as professionals. It is unlikely incentives for housing affordability will drive any new, sophisticated low-scale urban development here in Hobart; most developers are not that thinking.There is very little multi-housing development here anyway, and most developers try to use draftsman and avoid the ‘expense’ of an architect. Federal budgets mean little to architects in my view, as we undertake quite specific and specialist work. The amount of work in Tasmania for architects is really driven by house prices in Melbourne and Sydney; and this is a market and share market/Aus dollar driven realm – not Federal Govt budget. So, if the market in Sydney and Melbourne collapses and house prices there fall, less people will look to invest in Tasmania as an alternative, as we are currently on the rise (although we’re coming from a low base).

It is unknown (and I’d say unlikely) that Tas will see much of the infrastructure funding, and if it does it is most likely going to go toward road upgrades, not urban renewal projects. The current Tas State Government (and their Infrastructure Minister) is only just warming to the concept that infrastructure is more than ‘roads’. And we have no State Architect here advising government on the capacity for investment, urban renewal and new urban infrastructure to drive consumer confidence and civic price (which then attracts investment). We need that message to get through to the govt in Tas so they steer funding toward such projects. However, they have a massive health and hospital problem on their hands here, so urban renewal is not seen as a priority for funding and votes.”

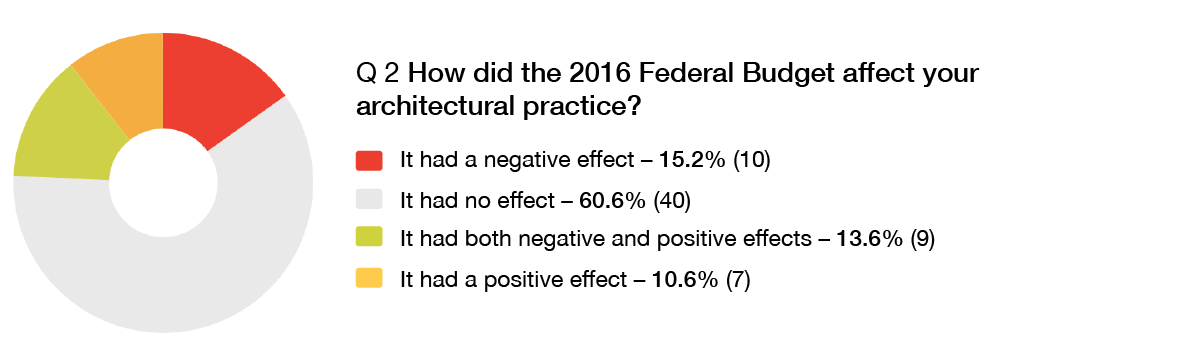

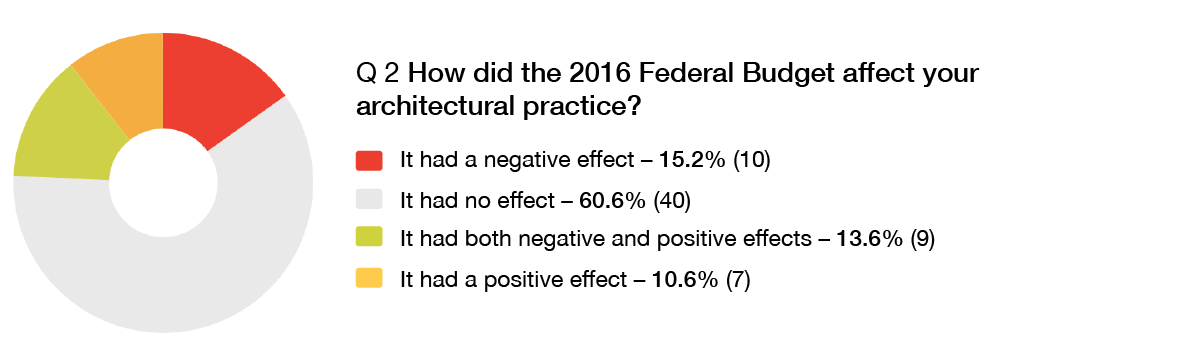

Impact of last year’s budget

Only six people made further comment, all of a limited nature. Three comments related to particular sectors – including work arising from funding for health and defences projects. One referred to the tax reduction for small business, while another mentioned that they hadn’t used the $20K instant asset write-off.

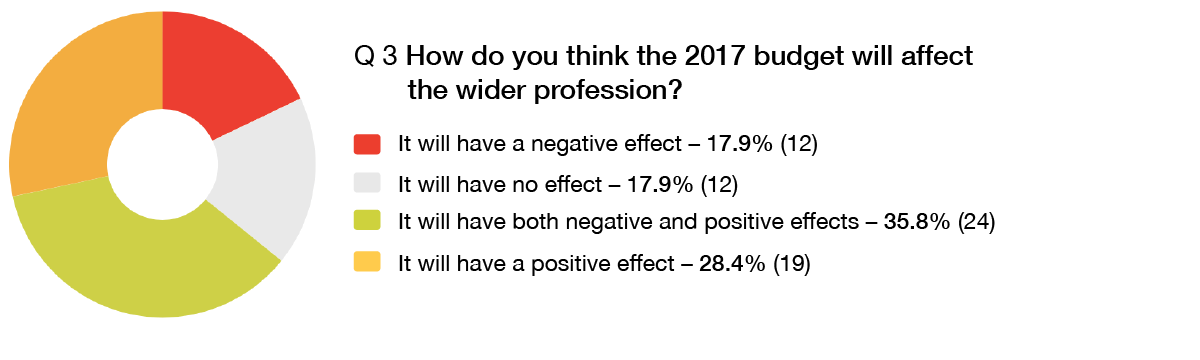

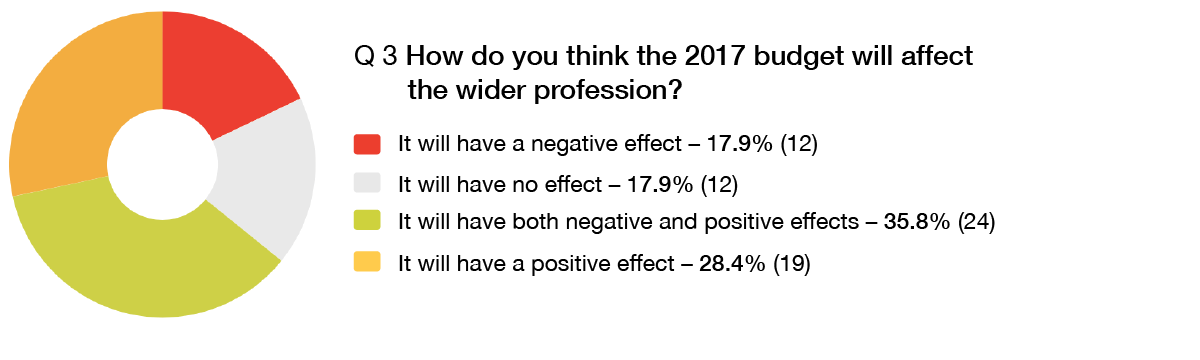

Impact on the wider profession

Fifteen people provided further comment, with most being ambivalent in their comments and others repeating their comments from question 1. A range of responses follows:

“There are some positives and some negatives but the net effect is little.”

“More certainty as it will most likely pass the senate.;

“Environment and the arts have been seemingly left out of the budget.”

“Anticipated growth will drive accommodation needs.”

“Potential impacts on university students and graduates.”

“Maybe, it’s hard to tell. It depends upon currency markets and consumer confidence. If the Federal Budget drives up consumer confidence, then that will drive investment, which will make for a healthier climate for people approaching the profession to engage with us. The infrastructure investments may do this, but it requires the Government to make good on its infrastructure pledges in a timely manner, so it flows through to confidence for other projects to proceed.”

“The optimistic feel of the budget will stimulate spending.”

“Infrastructure up and we expect a slow down in housing with restrictions on foreign investors.”

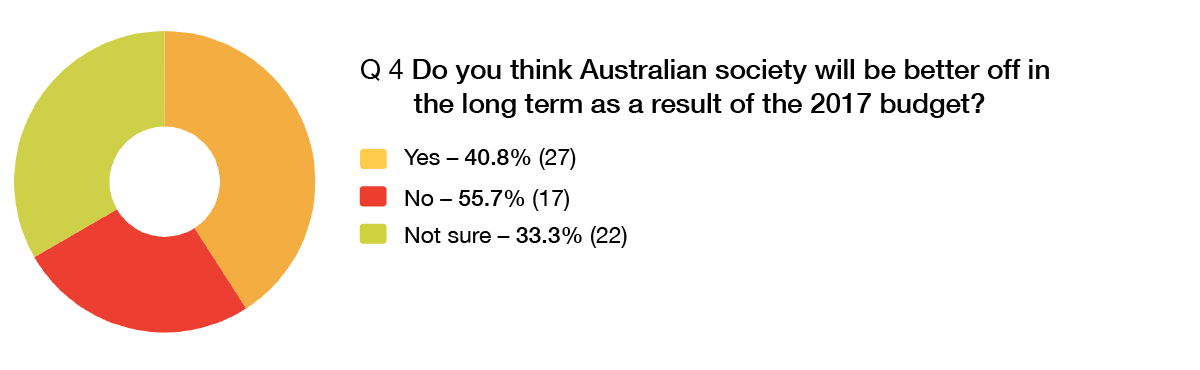

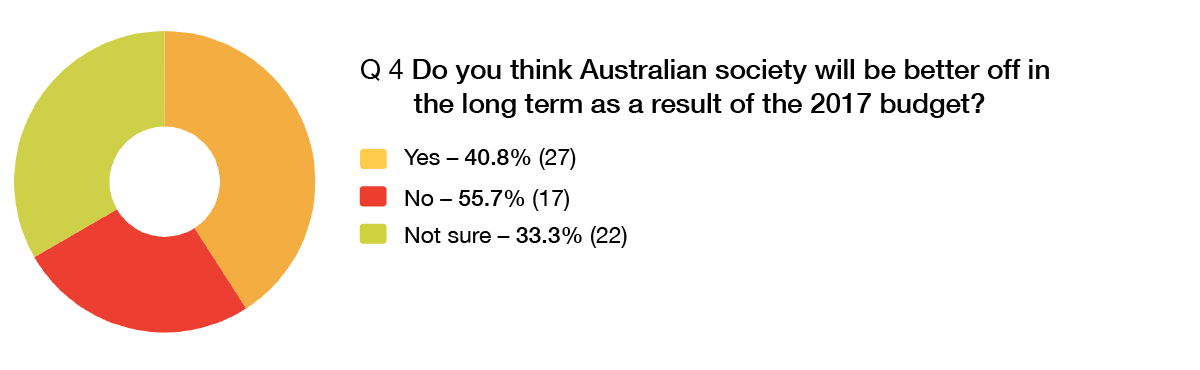

Impact on Australian society

Eleven people took the opportunity to comment further. As in the comments from previous years, there is concern about the lack of action on climate change.

“The higher income earner should be paying a bigger proportion of the revenue collected. Crushing the lower income earners of society will ultimately slow the economy more. Everyone needs to have spending power and have reasonable education and health services for a viable growing society. Capital gains tax phase-out will do more for first home buyers and housing affordability than fiddling their Super. Making the rich richer and poor poorer is a trend that ultimately collapses and the rich will wander around poking for their living amongst the rubble of the poor who could not reach their potential.”

“Need to close tax loop holes on big business. Should not be penalising the low socio economic groups – e.g. with the raised medicare surcharge. No mention of climate change. Ridiculous. Not enough assistance to first home buyers.”

“It may mean the LNP stays in power in a centreist position which would be a good thing.”

“Environment in paricular left out.”

“Too much debt.”

“There is a plausible plan to bring the budget back into surplus within a reasonable time frame..”

“A focus on improving housing affordability is a step in the right direction. Pity it is 30 years too late!”

“Possibly. I ignore any projections about surpluses etc. They are a waste of time and amount to political statements only. But there are some measures (such as accessing super for house deposits) and placing levy on bank super profits that may create more equality.”

“Lack of focus on real housing affordability measures, reduction in health and education over the longer term, no increase in Indigenous housing funding, no move to ETS, not enough cutbacks on middle class welfare.”

“Increasing the Medicare levy, funding the second Sydney airport, inland rail project and the NDIS are positive ing term decisions.”

“Infrastructure good. Budget assumes 3 to 4% growth in wages to fund taxes. Cant see that happening.”

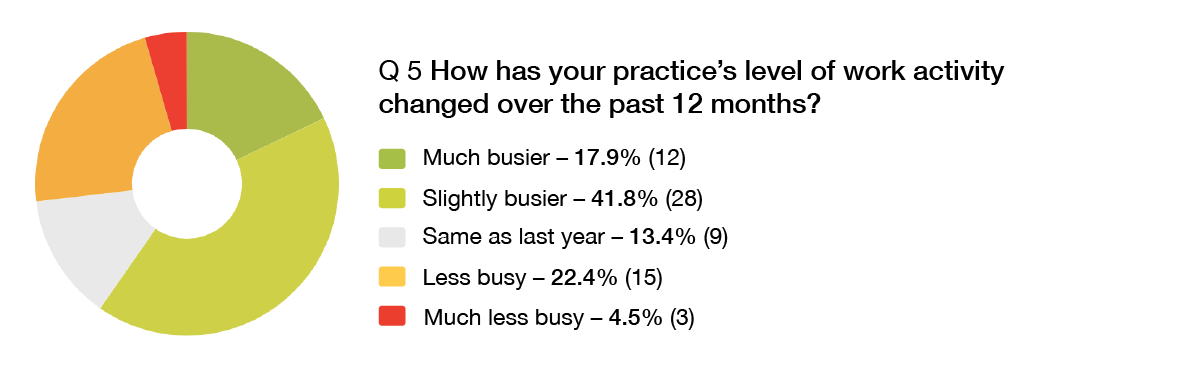

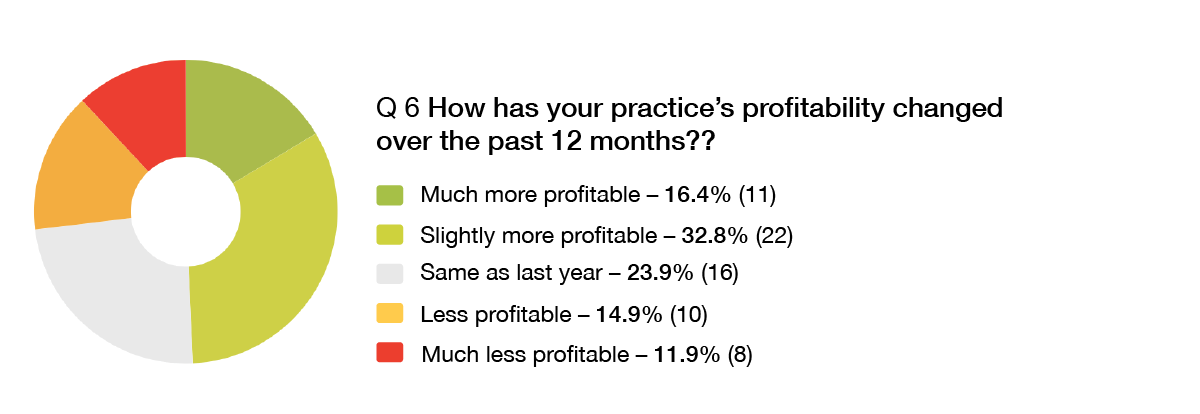

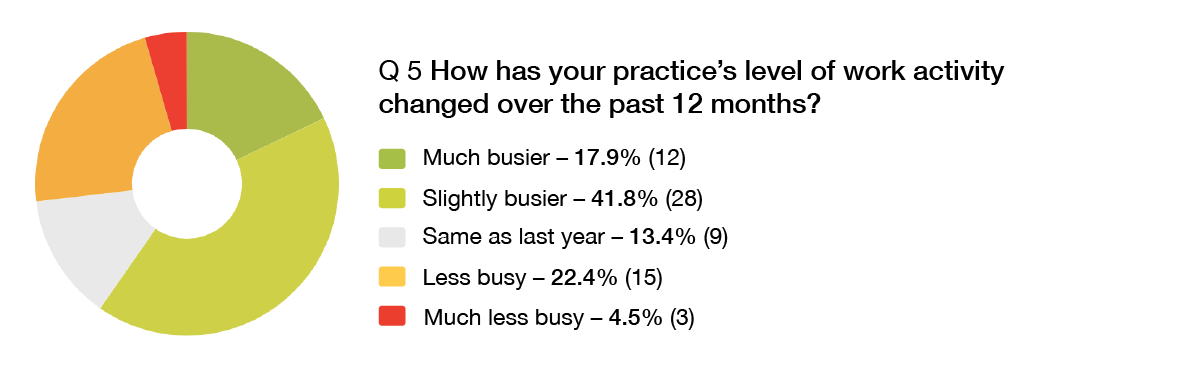

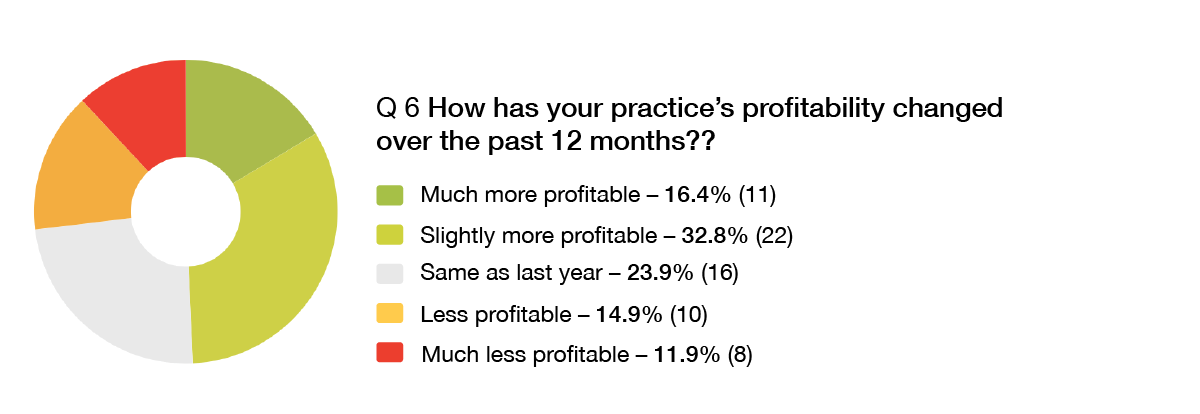

Activity and profitability over last 12 months

Last year we introduced two new questions to the Budget Impact Survey, to better track changes in activity and profitability. Responses to both questions indicate that things continue to look up for many practices. Close to 60% of respondents are busier than last year. However, like last year, this increased activity has not translated into increased profit for the same proportion – only 49% report increased profitability. At the other end of the scale, a quarter of practices are less busy and less profitable – an increase on last year.

Who responded to the survey?

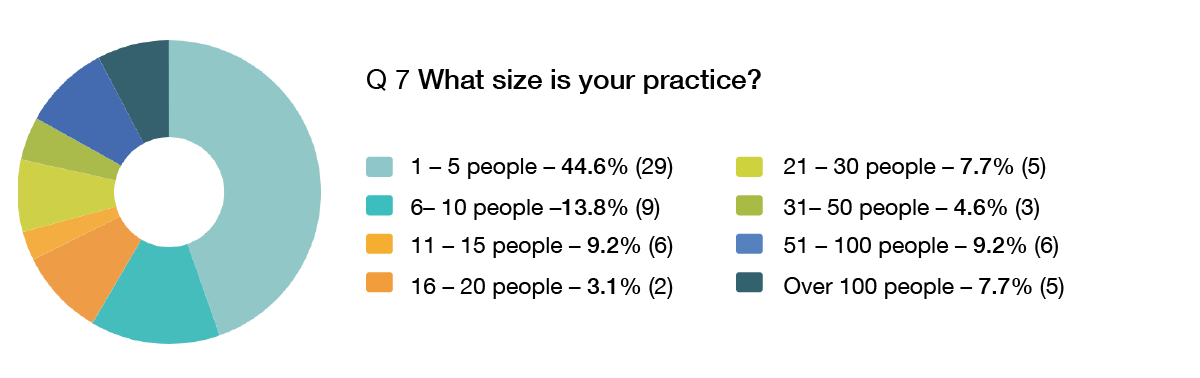

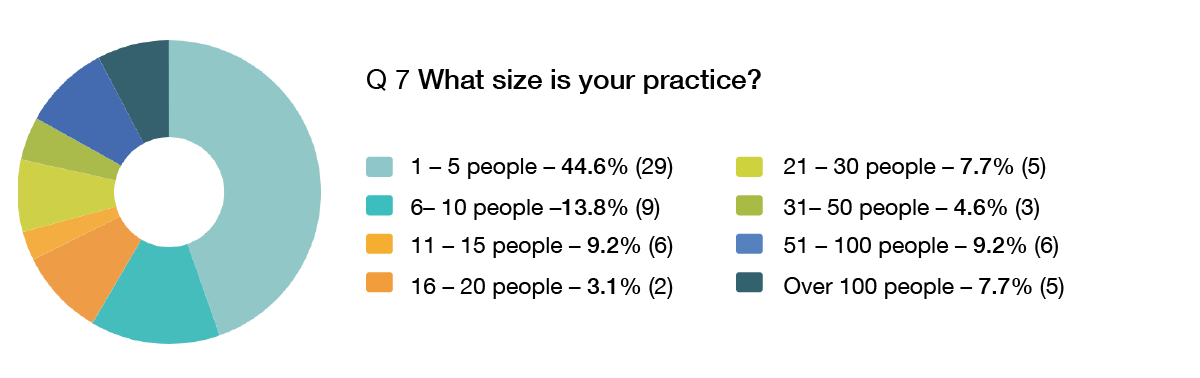

The second set of questions was designed to give a better understanding of the demographics of those who responded.

The majority of respondents were directors, partners or owners of an architectural practice. Respondents came from firms ranging from small practices to firms of over 100 staff. The profile of respondents reflects the structure of the profession in that a large proportion of respondents ran small practices. A wide range of types of work was represented.

Size of practice

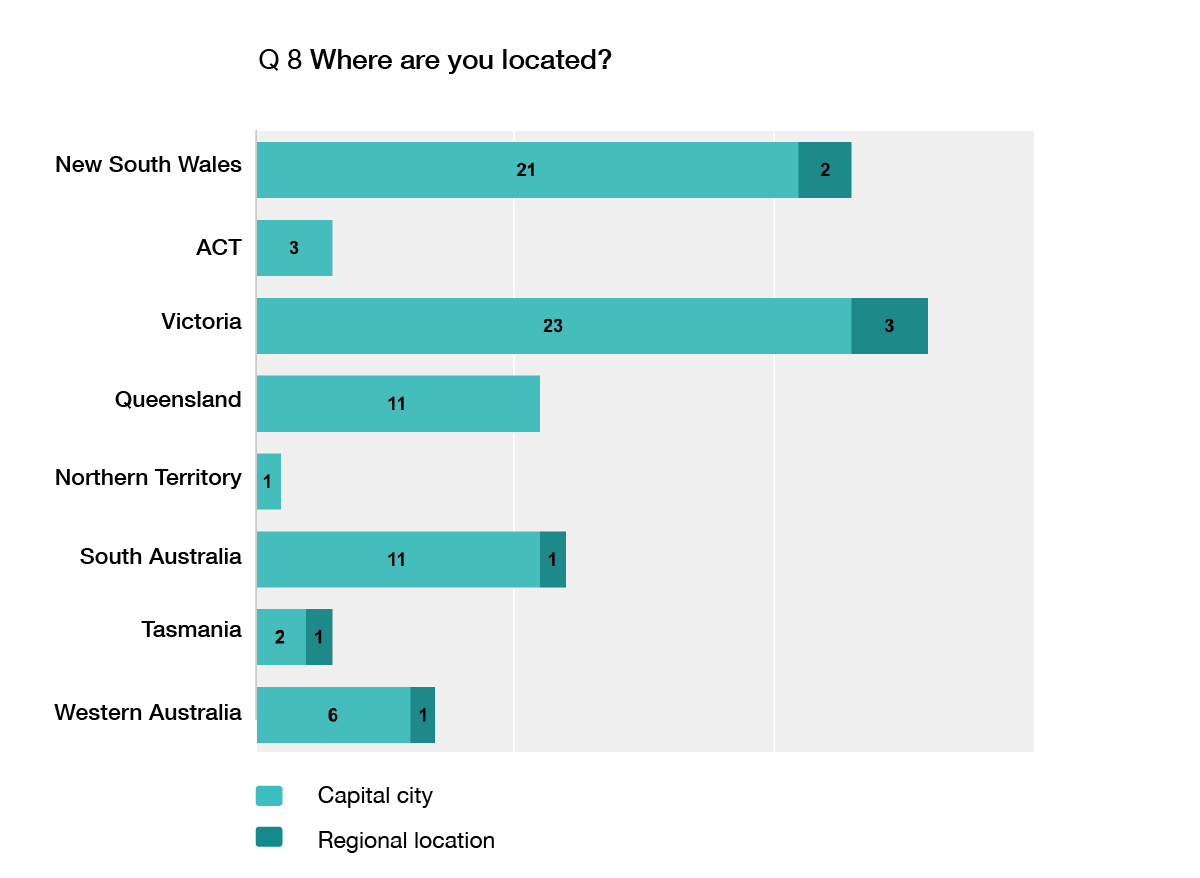

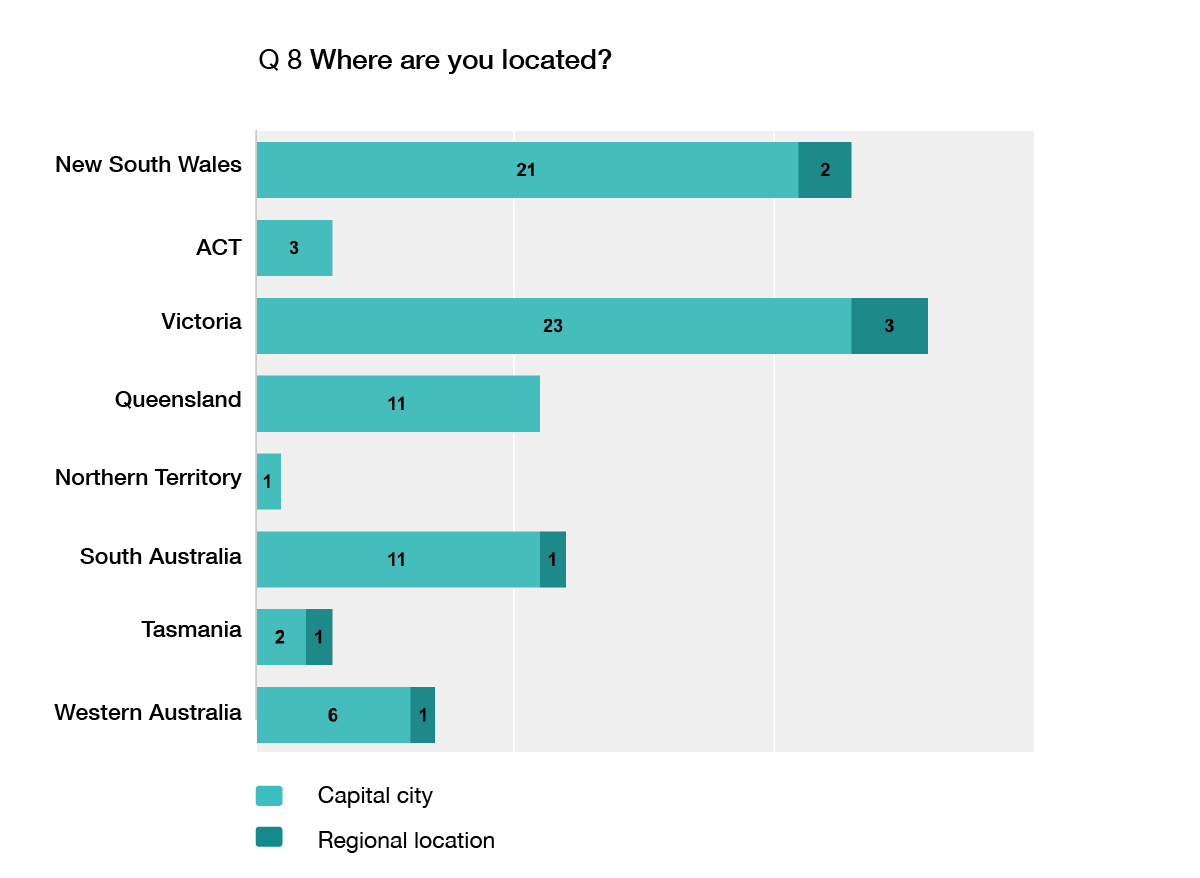

Location

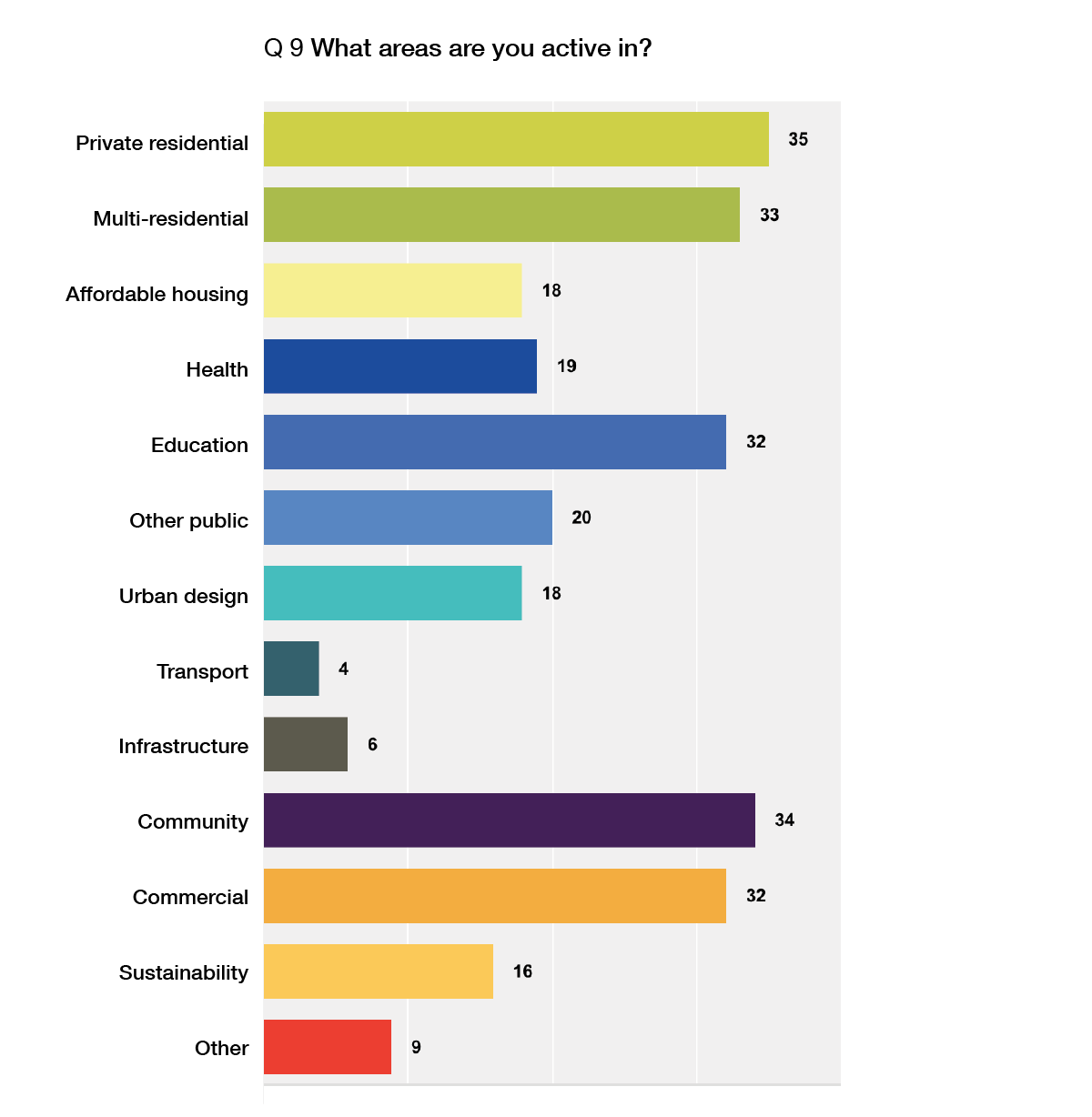

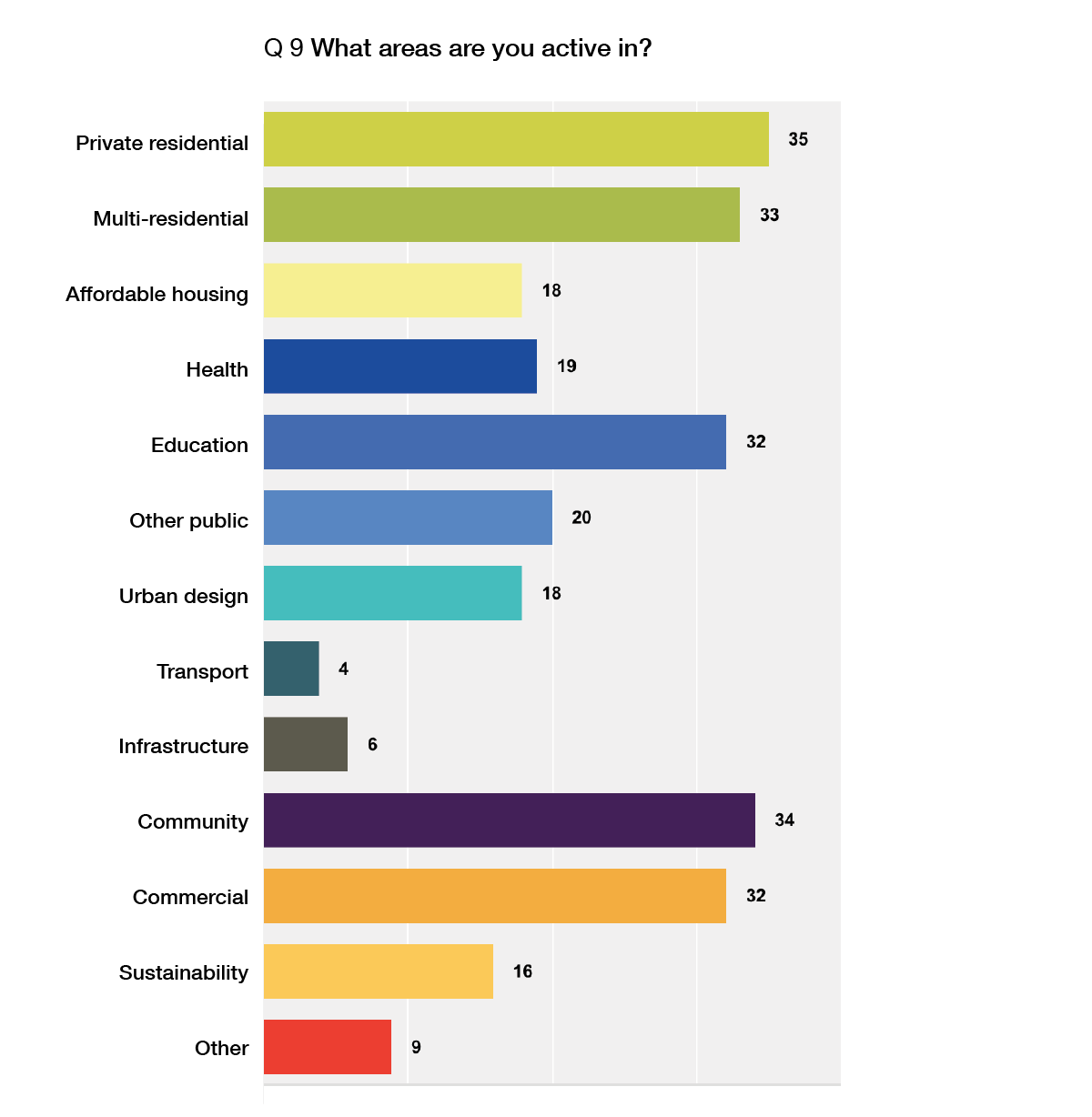

Types of work

Nine respondents identified a range of other sectors in addition to those available in the tick box section, some of which provided a finer level of detail for available options. These included aged care, master planning, town planning, sport, heritage and adaptive reuse, defence, and tourism.

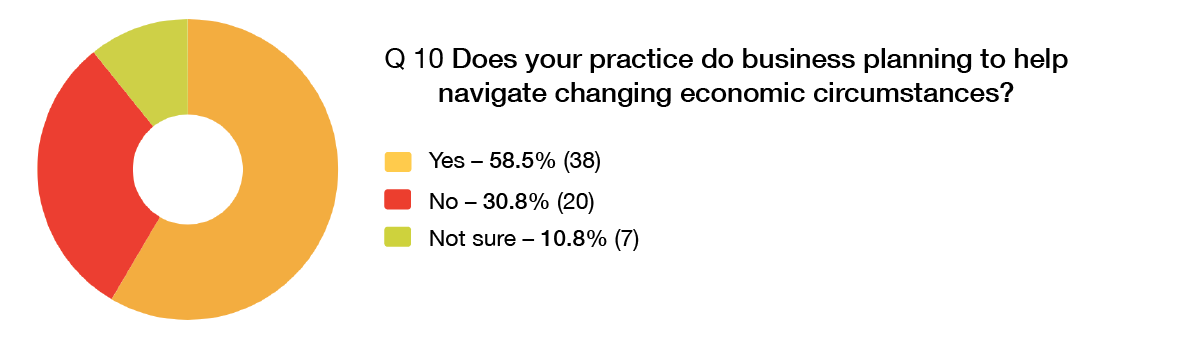

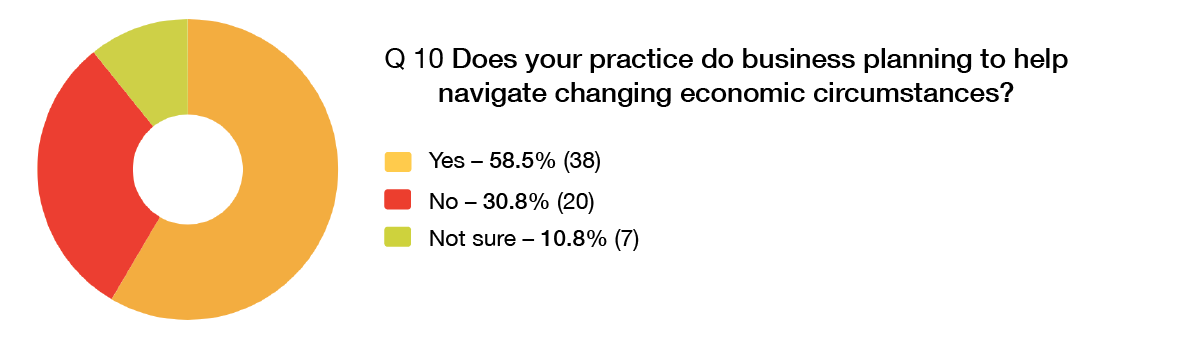

How do practices plan to navigate economic changes?

The ACA was also interested to know if and how practices engage in business planning to help navigate shifting economic circumstances. Once again the proportion of respondents that indicated they did conduct business planning has increased slightly since last year. Twenty-one practices gave some insight into strategies. Comments included:

“Will look at areas where there might be more local government investment – we have a track record in community type projects such as child care and sports pavilions.”

“Vote ALP.”

Same as currently – targeted clients and sectors, in particular multi unit housing, infrastructure, education – all the areas which in the budget received funding.

“Develop pathways and follow the money.”

“Focus on private clients, and overseas work.”

“Look for more tender opportunities.”

“Maintain current marketing strategy and expand into sectors advantaged by the budget such as infrastructure.”

“Diversified client base. Never one big client. Avoiding key client risk. And key person risk.”

“Review assets and tax minimisation strategies, look at overall business costs, educate staff about voluntary super top-ups.”

“New practice management system being implemented at present.”

“Little, but I don’t think it will really influence what we actually do. However, locally I will certainly be trying to push the message to State Government of the opportunities created by good urban design strategy and investment in multi-layered public transport initiatives (Hobart has no rail, few bike pathways and no ferries – it only has a bus system). Design in public infrastructure means a better functioning city, which translates to attracting investment.”

“We are currently aggressively pursuing education and health opportunities.”

“We are constantly on the look out for new opportunities so additional expenditure in some sectors opens up opportunities whereas reduce spending may reduce opportunities.”

“Gradually educating ourselves in business planning measures. Planning on improving them this year.”

“Our sector unaffected. Except for diminishing household discretionary spend”

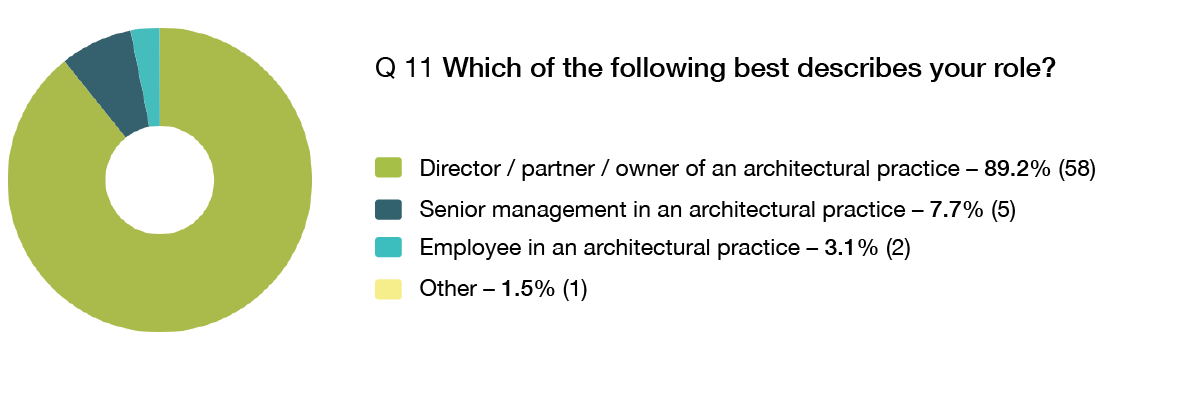

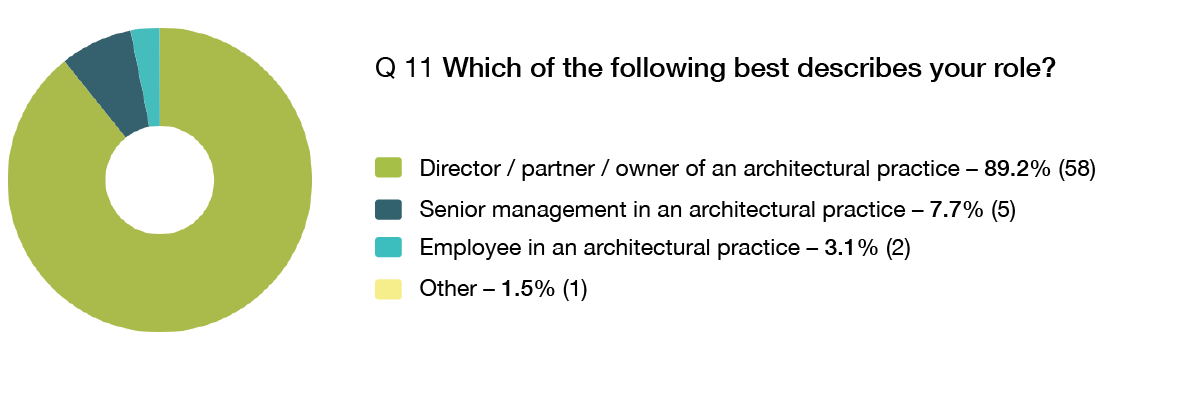

Respondents roles within practice

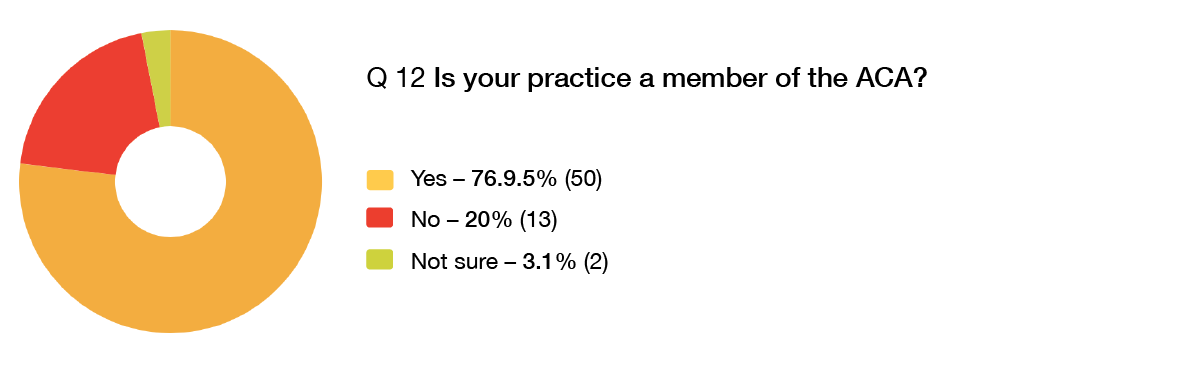

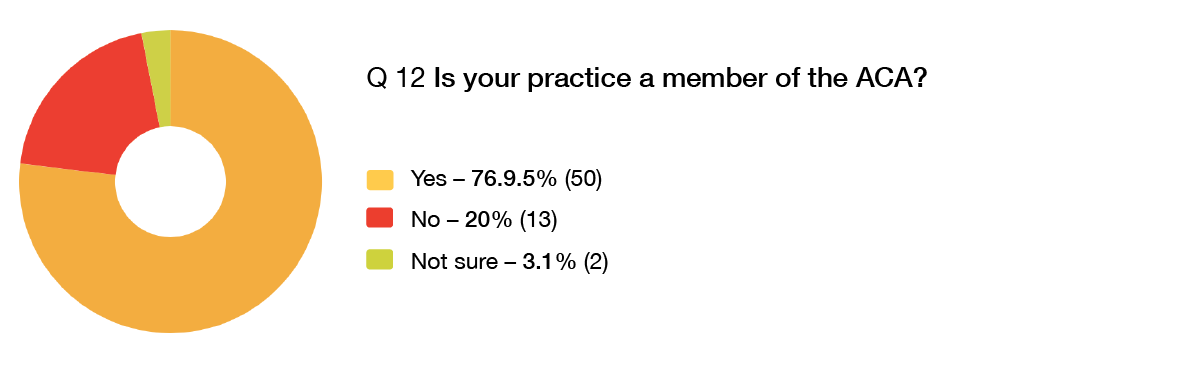

ACA members

The survey was open to all, and we aimed to get a broad range of responses within the limited timeframe the survey was open for. We were pleased with the high proportion of responses from ACA members, but also pleased to attract interest from non-members. The ACA will continue to advocate for better business conditions for all architects – and we encourage those who are not currently members to join us in this!

The ACA’s 2017 Federal Budget Impact Survey aims to understand what the budget means for architectural practices and the profession, and thereby inform ACA advocacy and activity. We present the results below, and encourage members to also read John Held’s analysis of this year’s results.

The first set of questions aimed to provide a general understanding of the expectations of the impact of the budget on individual practices, the profession and society more broadly.

Impact on practices

Almost half of respondents see the budget as having no effect on their practice. Most of the 16 people who took the opportunity to comment made very brief comments. A number suggest that the support for housing and infrastructure may have some impact on architects. Cuts to the higher education sector are a concern for some working in the area, as is the lack of health funding. A sample of comments includes:

“There are some positive outcomes, such as funding for roads and rail in WA, however, with funding for universities getting tightened there will be fewer campus projects.”

“-ve: implications to Western Australia in loss of health and education revenue, reduction (as always) of GST share. +ve: infrastructure spend – metronet.”

“Minimal health funding for new projects.”

“Business confidence plus the big infrastructure spend should boost business.”

“Infrastructure items are supported; changes to superannuation for access to funds for house purchases for first home buyers are supported.”

“Only if we use the $20K instant asset write-off, which we may not do.”

“Possibly with the tax cuts, but they may not affect the size of our business.”

“Cutting red tape on building applications – though this may have a negative affect if it allows building companies to get applications through without the use of architects.”

“Infrastructure spend will flow to government projects in education and other areas.”

“Bank tax will bite us all.”

“Less uncertainty with the removal of the zombie measures and funding commitment for NDIS.”

“Positive for revenue, poor outcomes for environmental effects IMO.”

“Running a small scale practice in Tasmania, the key budget strategies will have no affect at all. There is nothing in the budget (aside from the 1 year continuation of the $20,000 asset write off) that will have any effect on what we do as professionals. It is unlikely incentives for housing affordability will drive any new, sophisticated low-scale urban development here in Hobart; most developers are not that thinking.There is very little multi-housing development here anyway, and most developers try to use draftsman and avoid the ‘expense’ of an architect. Federal budgets mean little to architects in my view, as we undertake quite specific and specialist work. The amount of work in Tasmania for architects is really driven by house prices in Melbourne and Sydney; and this is a market and share market/Aus dollar driven realm – not Federal Govt budget. So, if the market in Sydney and Melbourne collapses and house prices there fall, less people will look to invest in Tasmania as an alternative, as we are currently on the rise (although we’re coming from a low base).

It is unknown (and I’d say unlikely) that Tas will see much of the infrastructure funding, and if it does it is most likely going to go toward road upgrades, not urban renewal projects. The current Tas State Government (and their Infrastructure Minister) is only just warming to the concept that infrastructure is more than ‘roads’. And we have no State Architect here advising government on the capacity for investment, urban renewal and new urban infrastructure to drive consumer confidence and civic price (which then attracts investment). We need that message to get through to the govt in Tas so they steer funding toward such projects. However, they have a massive health and hospital problem on their hands here, so urban renewal is not seen as a priority for funding and votes.”

Impact of last year’s budget

Only six people made further comment, all of a limited nature. Three comments related to particular sectors – including work arising from funding for health and defences projects. One referred to the tax reduction for small business, while another mentioned that they hadn’t used the $20K instant asset write-off.

Impact on the wider profession

Fifteen people provided further comment, with most being ambivalent in their comments and others repeating their comments from question 1. A range of responses follows:

“There are some positives and some negatives but the net effect is little.”

“More certainty as it will most likely pass the senate.;

“Environment and the arts have been seemingly left out of the budget.”

“Anticipated growth will drive accommodation needs.”

“Potential impacts on university students and graduates.”

“Maybe, it’s hard to tell. It depends upon currency markets and consumer confidence. If the Federal Budget drives up consumer confidence, then that will drive investment, which will make for a healthier climate for people approaching the profession to engage with us. The infrastructure investments may do this, but it requires the Government to make good on its infrastructure pledges in a timely manner, so it flows through to confidence for other projects to proceed.”

“The optimistic feel of the budget will stimulate spending.”

“Infrastructure up and we expect a slow down in housing with restrictions on foreign investors.”

Impact on Australian society

Eleven people took the opportunity to comment further. As in the comments from previous years, there is concern about the lack of action on climate change.

“The higher income earner should be paying a bigger proportion of the revenue collected. Crushing the lower income earners of society will ultimately slow the economy more. Everyone needs to have spending power and have reasonable education and health services for a viable growing society. Capital gains tax phase-out will do more for first home buyers and housing affordability than fiddling their Super. Making the rich richer and poor poorer is a trend that ultimately collapses and the rich will wander around poking for their living amongst the rubble of the poor who could not reach their potential.”

“Need to close tax loop holes on big business. Should not be penalising the low socio economic groups – e.g. with the raised medicare surcharge. No mention of climate change. Ridiculous. Not enough assistance to first home buyers.”

“It may mean the LNP stays in power in a centreist position which would be a good thing.”

“Environment in paricular left out.”

“Too much debt.”

“There is a plausible plan to bring the budget back into surplus within a reasonable time frame..”

“A focus on improving housing affordability is a step in the right direction. Pity it is 30 years too late!”

“Possibly. I ignore any projections about surpluses etc. They are a waste of time and amount to political statements only. But there are some measures (such as accessing super for house deposits) and placing levy on bank super profits that may create more equality.”

“Lack of focus on real housing affordability measures, reduction in health and education over the longer term, no increase in Indigenous housing funding, no move to ETS, not enough cutbacks on middle class welfare.”

“Increasing the Medicare levy, funding the second Sydney airport, inland rail project and the NDIS are positive ing term decisions.”

“Infrastructure good. Budget assumes 3 to 4% growth in wages to fund taxes. Cant see that happening.”

Activity and profitability over last 12 months

Last year we introduced two new questions to the Budget Impact Survey, to better track changes in activity and profitability. Responses to both questions indicate that things continue to look up for many practices. Close to 60% of respondents are busier than last year. However, like last year, this increased activity has not translated into increased profit for the same proportion – only 49% report increased profitability. At the other end of the scale, a quarter of practices are less busy and less profitable – an increase on last year.

Who responded to the survey?

The second set of questions was designed to give a better understanding of the demographics of those who responded.

The majority of respondents were directors, partners or owners of an architectural practice. Respondents came from firms ranging from small practices to firms of over 100 staff. The profile of respondents reflects the structure of the profession in that a large proportion of respondents ran small practices. A wide range of types of work was represented.

Size of practice

Location

Types of work

Nine respondents identified a range of other sectors in addition to those available in the tick box section, some of which provided a finer level of detail for available options. These included aged care, master planning, town planning, sport, heritage and adaptive reuse, defence, and tourism.

How do practices plan to navigate economic changes?

The ACA was also interested to know if and how practices engage in business planning to help navigate shifting economic circumstances. Once again the proportion of respondents that indicated they did conduct business planning has increased slightly since last year. Twenty-one practices gave some insight into strategies. Comments included:

“Will look at areas where there might be more local government investment – we have a track record in community type projects such as child care and sports pavilions.”

“Vote ALP.”

Same as currently – targeted clients and sectors, in particular multi unit housing, infrastructure, education – all the areas which in the budget received funding.

“Develop pathways and follow the money.”

“Focus on private clients, and overseas work.”

“Look for more tender opportunities.”

“Maintain current marketing strategy and expand into sectors advantaged by the budget such as infrastructure.”

“Diversified client base. Never one big client. Avoiding key client risk. And key person risk.”

“Review assets and tax minimisation strategies, look at overall business costs, educate staff about voluntary super top-ups.”

“New practice management system being implemented at present.”

“Little, but I don’t think it will really influence what we actually do. However, locally I will certainly be trying to push the message to State Government of the opportunities created by good urban design strategy and investment in multi-layered public transport initiatives (Hobart has no rail, few bike pathways and no ferries – it only has a bus system). Design in public infrastructure means a better functioning city, which translates to attracting investment.”

“We are currently aggressively pursuing education and health opportunities.”

“We are constantly on the look out for new opportunities so additional expenditure in some sectors opens up opportunities whereas reduce spending may reduce opportunities.”

“Gradually educating ourselves in business planning measures. Planning on improving them this year.”

“Our sector unaffected. Except for diminishing household discretionary spend”

Respondents roles within practice

ACA members

The survey was open to all, and we aimed to get a broad range of responses within the limited timeframe the survey was open for. We were pleased with the high proportion of responses from ACA members, but also pleased to attract interest from non-members. The ACA will continue to advocate for better business conditions for all architects – and we encourage those who are not currently members to join us in this!