State of the Insurance Market

The world of insurance has changed rapidly over the last 12 to 18 months. Victorian State Manager of Planned Cover Laurence Gottlieb gives us an overview of a toughening market.

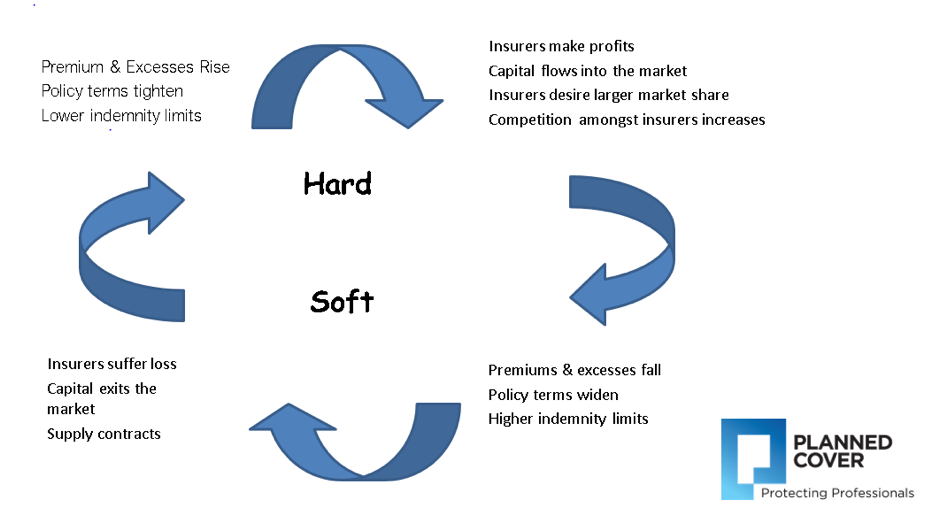

The insurance market is cyclical and after more than ten years in a soft market, we are well and truly in the middle of a hard market. The Australian insurance market is driven by both the local market and Lloyd’s of London. Lloyd’s is not an insurance company but a market where syndicates join together to form the world’s largest insurance market. Australia is the fourth largest market for Lloyd’s and the Australian professional indemnity (PI) market is directly connected to the UK market. Market trends in the UK often directly impact the Australian market.

Before 2017 there was widespread overcapacity in the Australian market, high levels of competition and soft, unsustainable rates. These conditions continued to attract new entrants, driving up competition and pushing premiums down further. Natural disasters pushed Lloyd’s to a 2017 underwriting loss of $6.3 billion, with PI contributing losses of $800 million.* The 2018 loss was $1.8 billion* and Lloyd’s identified international PI as the second least profitable line. A number of syndicates then exited the PI market, resulting in reduced capacity, particularly for building and construction risks. The year 2019 has seen a continued rapid decrease in capacity in the PI market globally. This is due to a number of factors, including:

- Increasing loss ratios (i.e., underwriting years where the total amounts paid out on claims exceeds premiums written by insurers).

- The pressure on all insurers with significant catastrophe risk.

- An increase in the number and severity of PI claims in the construction sector.

- An increasingly litigious construction sector with consultants often being sued for what is really poor workmanship.

- Claims in relation to non-compliant cladding. The cost of cladding claims has not been factored into prior year premiums and so insurers need to pay for losses with future premiums (and also attempt to exclude future cladding claims).

Given all these factors, insurers globally are looking to increase premiums for professional indemnity insurance and all business lines, and the insurers remaining in the market have increased premiums, excesses and exclusions, and reduced cover.

There has been a decade of a soft PI insurance market for architects and other construction industry professionals. The market has hardened very quickly over the last 12 months and insurers are looking for a minimum of 10% to 20% rate increases for architects. Some professions, such as fire engineers, structural engineers and building surveyors, are facing increases of more than 100%. Coverage is decreasing by way of new exclusions, increasing excesses and reducing limits.

In addition to the “insurance crisis”, we are also in the midst of a construction industry crisis. Confidence in the construction industry is at an all-time low. It seems that every week or so there is a new “defective, “shoddy” or “falling apart” building on the front pages of the newspapers.

There is also the “cladding crisis”. The latest cost estimate of fixing defective cladding is about $6 billion. Victoria is the first state to set up a new agency dedicated to the rectification of non-compliant cladding and has earmarked a pool of $600 million. It remains to be seen whether other states will follow.

In a recent submission to the NSW Public Accountability Committee, the Insurance Council of Australia stated: “A number of high profile compliance failures in NSW, coinciding with use of non-conforming and potentially dangerous external cladding on modern and some refurbished buildings, has led to a crisis in confidence for insurers who provide professional indemnity coverage for building professionals and increasingly for insurers who insure the physical buildings once construction has been completed.”

Most PI insurers have now introduced exclusions for claims arising from the use of non-compliant cladding, and due to the claims-made nature of PI policies, these exclusions could leave professionals uninsured for past projects.

Not all exclusions are equal. As always, the devil is in the detail. Some are very broad and exclude “any building material that is non-conforming or non-compliant with the National Construction Code, the Building Code of Australia, the Australian Standards or any other applicable laws or regulations”. This type of exclusion goes well beyond non-compliant cladding and leaves the architect uninsured for claims arising from any non-compliant material or potentially design. This could include tiles, screws, glass, railings etc.

On the other hand, there are more moderate exclusions which seek to exclude claims arising only from the use of non-compliant Aluminium Composite Panels, or even narrower ones which just exclude Aluminium Composite Panels with a Polyethylene core. It is important to note that no matter how narrow or broad the exclusion, it will apply to all projects, past and future, unless it specifically states that it only applies to future work or work after a certain date.

We recommend that you discuss any non-compliant product exclusion with your insurance broker to ensure you fully understand the extent of the exclusion and the potential impact it may have on your business. With the hardening market and new exclusions being applied, it is more important than ever to give the renewal process the attention it needs. We recommend completing your proposal form promptly to ensure your broker has sufficient time to look at options and negotiate any exclusions with insurers.

* Department of Housing and Public Works PWC Report 24 June 2019

Laurence Gottlieb is a lawyer by profession and also worked in corporate finance for different banks in South Africa before moving to Australia in 2002. Since then he has worked at different insurance brokerages and has had 15 years’ experience in professional risks, specialising in professional indemnity insurance. Laurence has been the Victorian State Manager of Planned Cover since 2008, providing insurance placement and advice, risk management and claims management services, primarily to construction professionals.